As 2023 draws to a close, analysts at Yole Group reflect on what’s driving ADAS and AD. Traditional sensors will share the market with new sensor technologies. In 2022, sensor shipments in the global automotive market will reach 5.4 billion units, including image sensors, magnetic sensors, MEMS pressure sensors, etc. The market research and strategy consulting firm expects strong growth of 7% between 2022 and 2028, with global sensor shipments rising to 8.3 billion units.

In today’s article, Yole analysts focus on ADAS and AD and highlight each industry’s market, latest innovations, ecosystem evolution, and especially the supply chain.

Automotive thermal imaging camera adoption may change in the future

For standard or traditional image sensors, the main players are almost unchanged and remain onsemi, Omnivision and Sony. As security features evolved, resolutions continued to increase, from 1-2Mpixel to today's design efforts associated with 8Mpixel cameras.

On May 31, 2023, the U.S. National Highway Traffic Safety Administration (NHTSA) proposed a new standard that would make AEB mandatory on light cars and trucks within four years of issuance. The regulation will be stricter, requiring pedestrians to be detected even in dark conditions. This latter situation could be a game-changer, as current AEB works well with radar and visible light cameras, but the hardware's performance in dark conditions is very low. This means that OEMs can implement another sensor to meet this condition. Thermal cameras are insensitive to low-light emissions, which makes them superior to camera- and radar-based emergency braking systems. Thermal cameras perform well when there are curves in the road, bad weather, or low light conditions. The simplicity of adding pedestrian detection algorithms could be a great opportunity for thermal cameras to eventually make their way into the automotive industry, but the cost of thermal cameras compared to vision cameras remains a major barrier to adoption. Other sensors such as gated imaging cameras or lidar may also be used to meet the performance requirements of the new AEB regulations.

The automotive camera and image sensor market revenue has grown significantly as safety regulations and chip shortages have led to increased demand and higher prices. According to an automotive imaging report released by Yole Group this year, the automotive camera market size will increase from US$5.4 billion to US$9.4 billion in 2028, with a compound annual growth rate of 9.7%. Yole Group analysts explain that by 2028, 94% of cars will be equipped with ADAS cameras, and in-car cameras for DMS and OMS will grow rapidly.

Automotive radar: a market driven by safety regulations and innovation

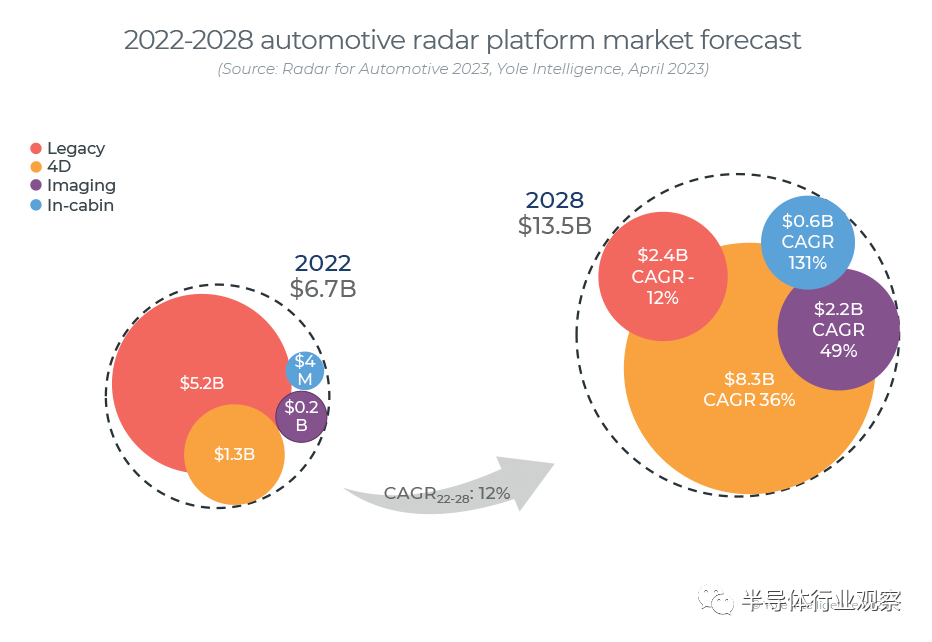

The number of radar modules per vehicle will increase from 1.7 in 2022 to an average of 3.1 in 2028. As a result, automotive radar modules are expected to grow at a CAGR of 12% between 2022 and 2028, from $6.7 billion to $13.5 billion. Yole Group classifies traditional radar as the standard radar today, but 4D radar is expected to dominate, generating approximately 60% of market revenue by 2028.

Designed to replace traditional radar, 4D radar has elevation capabilities and better resolution. In fact, 4D radar has an angular resolution of 1°, which significantly improves object discrimination compared to the 4-6° angular resolution of 3D radar. But this increase in performance requires more computing power to process all this data. Here, innovation is driven by Arbe Robotics (more news), Uhnder and Metawave. These startups either use [AMD/Xilinx] FPGAs or (in the case of Arbe Robotics) produce their own ASICs to replace traditional MCUs. In 2023, computing is often embedded in the radar module, but in the coming years we expect to see an increase in the separation of the computing part from the radar module.

LIDAR for ADAS: market share is growing strongly…

The passenger car LiDAR market has grown rapidly since 2021, with an increase of an astonishing 285%. In 2022, the passenger car lidar market will surpass the robotaxi lidar market for the first time. LiDAR adoption is driven by Chinese OEMs, especially new manufacturers building pure electric vehicles.

Innovusion, Valeo, Hesai and Sagitar lead the market. Valeo dominates the passenger car lidar market share, for example with Audi and Mercedes, but with the emergence of Chinese suppliers, Valeo's market share will fall from 79% in 2021 to 2022 24% of the year. Innovusion leads the market in 2022 thanks to its partnership with Nio, but since the LiDAR market is still quite young, we expect the rankings to change quickly. In fact, Hesai and Sagitar Sensing each work with more than 14 OEMs, and their respective market shares should change in 2023 and 2024.

Chinese OEMs are rapidly implementing lidar using local suppliers, and by 2022, Chinese lidar manufacturers will control 73% of the market. They have little traction in Europe, mainly because OEMs have yet to launch large projects and the market is limited to high-end, low-volume vehicles, mainly supplied by Valeo.

Automotive computing continues to grow: Demand creates opportunity

The increasing number of sensors with better performance in terms of range and resolution has a direct impact on the demand for computing power in passenger cars. Overall, ADAS and cockpit processor computing revenue is growing rapidly, with a CAGR of 13% from 2022 to 2028, reaching $12.7 billion in 2028. Of the two categories, ADAS is the largest segment and will account for more than 60% of total revenue in 2028.

The computing market is also undergoing interesting changes. Mobileye has long dominated the automotive vision processor market, accounting for 52% of the market in 2022, followed by players such as AMD, Nvidia or Tesla.

The cockpit processor market is dominated by Qualcomm, which is a new player compared to rivals Renesas or NXP. Qualcomm is leveraging the user experience knowledge it gained in the smartphone market to enter the automotive market through the cockpit. But Qualcomm’s ultimate goal is not the cockpit market, but the more profitable ADAS market. We expect Qualcomm to quickly gain market share in the ADAS space and quickly become a significant player competing with Mobileye.

Today, Chinese companies such as Horizon, Black Sesame, and HiSilicon are winning design wins, and their market share is expected to increase significantly in the next five years. They are very active in both ADAS and cockpit areas.

In 2023, we will see many models released by Chinese automakers equipped with much higher numbers of sensors than other models released by European or American automakers. But due to the lack of regulation, these Chinese cars are still lumped into the "hands-off" category, like Tesla for comparison. If regulations change, we expect to enable more complex autonomous driving applications via OTA updates as the sensors and computing hardware are already in place.

Regarding closed-eyes applications, China has no regulations allowing such applications, but Chinese OEMs are developing NOA (Navigation for Autonomous Driving) systems. As for the rest of the world, Japan, Europe (Germany) have implemented unfocused regulations, and the UK and some US states (such as California and Nevada) are also stepping up.

100 billion automotive semiconductor devices by 2028: How to achieve it?

There is no doubt that the main drivers of the automotive semiconductor industry are electrification and ADAS. At Yole Group, the changes for 2023 have been clearly identified, analyzed in depth and presented in the dedicated automotive product range.

According to the Automotive Semiconductor Report, the price of semiconductor devices per vehicle will reach approximately $540 by 2022. By 2028, this number will grow to approximately $912 exclusively through the implementation of two market drivers. The related market will grow at a CAGR of 11.9% between 2022 and 2028, peaking at $84.3 billion during this period. Behind this number, Yole Group announced a semiconductor device market worth hundreds of billions.

Although semiconductors are critical to the ongoing disruptive transformation of the automotive industry, most players, whether OEMs or Tier 1 suppliers, have yet to develop a clear semiconductor strategy. Preparing for the future requires specific expertise in semiconductor technology and supply chains. The complexity of semiconductors needs to be managed. OEMs need to prioritize necessary ECUs and semiconductors and build new relationships with device manufacturers and foundries.

OEMs need to secure their supply chains, and to do this they are developing new strategies with semiconductor manufacturers, whether that is direct sourcing with companies like Infineon or Onsemi, or co-development with companies like STMicroelectronics or Foxconn, e.g. .

Global supply chains are evolving from OEMs purchasing black boxes to Tier 1 suppliers becoming more involved in the development of their products. Some OEMs, such as BYD, Toyota or Geely, can be vertically integrated in certain areas and are able to manufacture their own semiconductors. Other companies, like Li Auto or Tesla, have control over the design of their devices and only use foundries to build them. Here are just a few examples of these changes, 2024 will be a strategic year for all automotive companies.